What is a Limited Liability Company?

What is an LLC?

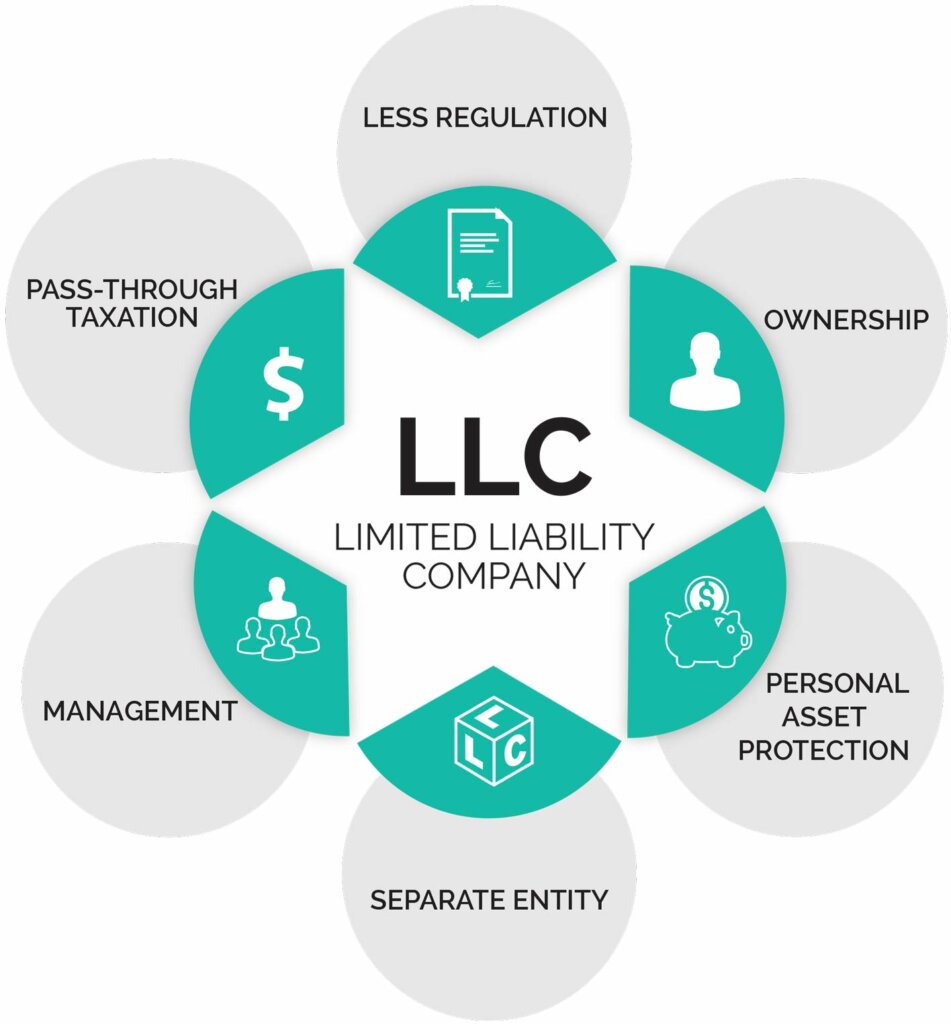

The Limited Liability Corporation is the simplest business structure for small business and you can see why with over 80% of small businesses being setup as an LLC! Read on to find out what is an LLC and what it is not.

The LLC traditionally has less requirements and gives enough flexible ownership options than other more complex business structures (such as the Corporation), and also provides the business owners with limited liability protection. This protection means that the company’s assets are separate from your personal assets and you are not liable for the business debts and obligations.

LLC Advantages

- There are No US Residency Restrictions. You do not need to be a US Citizen or permanent resident to start your LLC in the US.

- Pass-Through Taxes. You do not need to file a corporate tax return. You just report your share of the profit and loss on your regular tax return and thus avoid double taxation.

- Flexible Tax Reporting Options. LLCs have the option of being able to choose between filing taxes as a C-Corporation or as an S-Corporation.

- Liability Protection. You have limited liability for your business debts and obligations so your personal assets are protected.

- Higher Credibility. Other U.S. business entities will look more favorably on your business when it’s a registered LLC.

LLC Disadvantages

- Separate Banking – Since it’s required to keep your business finances separate from your personal finances, you will need to create a Business Bank Account. We set you up with one when you register your LLC or Corporation!

- Not Preferred By Investors. If you’re seeking to eventually get funded by Investors or IPO, they will prefer you to be registered as a corporation.

- LLCs can be treated differently in different states

LLC Requirements

- Operating Agreements – An internal document outlining the company’s governance, ownership, and rules around adding or removing members.

- Annual Reports – LLCs must file an annual or in some states a bi-annual report. Failing to file the report can potentially have your business dissolved.

For a more detailed discussion or more info about LLC’s feel free to schedule a free no-obligation call with one of our Lawyers or CPAs here

Comments